It’s time to update a critical support for our state’s poorest kids that has been deteriorating for 30 years: the Minnesota Family Investment Program (MFIP). MFIP is intended to help a family meet their basic needs when they’ve fallen on tough times. It supplies a basic cash grant while parents are working for pay too low to support their family, or when parents are looking for work.

MFIP reaches about 43,000 kids a month. Every year, we see a growing body of research demonstrating that when we invest in financial supports for families with limited resources, the children in those families have a much better shot at future economic success and healthy development. Unfortunately, our investment in MFIP has not kept up with that research.

In 1986, the MFIP grant was set at $532 for a family of three. Back then, that could cover the rent for a two-bedroom apartment with about $50 to spare. Today, it would not cover the cost of fair market rent anywhere in Minnesota. Depending on the county a family lives in, typical rent for a two-bedroom apartment now ranges from $659 to $1,028.

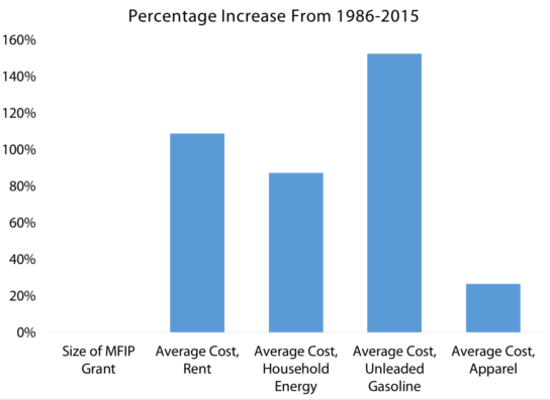

Rent isn’t the only cost that’s risen in the past 30 years. The graph below shows the average increase in gasoline, apparel and household utility prices since 1986, leaving MFIP families falling further and further behind.

Source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers, Minneapolis-St. Paul MSA

We were glad Governor Mark Dayton included a $100 increase to the monthly MFIP cash grant in his supplemental budget proposal. Policymakers should follow his lead. In the past 29 years, Minnesota’s poorest kids have already been told “wait ’til next year” 29 times too many.

-Ben Horowitz