In the debate about whether Minnesota should change its tax treatment of Social Security benefits, we’ve sought to draw attention to the significant tax exemptions that already are in place, which focus on low- and middle-income seniors.

The combined impact of existing federal and state income tax exemptions is that the majority of Minnesotans who receive Social Security do not pay state income taxes on it. House Research estimates that about 70 percent of Social Security benefits are already exempt from state income taxes, and 58 percent of households who receive Social Security do not pay any state income taxes on that income.

About 362,900 Minnesota seniors benefit from Minnesota’s current Social Security subtraction, receiving an average tax reduction of $255.

Proposals to expand this targeted approach

Because Minnesota already takes a targeted approach that prioritizes low- and middle-income Minnesotans, replacing it with an unlimited exemption gives the biggest new tax cuts to higher-income households. It also is extremely expensive, costing more than $1 billion per two-year state budget cycle, and growing over time with the number of seniors. That would make it much harder to make needed investments today, and maintain sustainable funding in the long run, for public services that seniors, their children, grandchildren, and communities count on.

Instead of the harmful effects from an unlimited exemption, some policymakers who want to make some changes to Social Security exemption have put forward more cost-effective alternatives that build on the state’s targeted approach. They would expand the number of folks who qualify for a state Social Security exemption and increase the amount of Social Security that would be exempt, and are designed not to provide large tax cuts to the highest-income Minnesotans.

Let’s take a closer look at two of them.

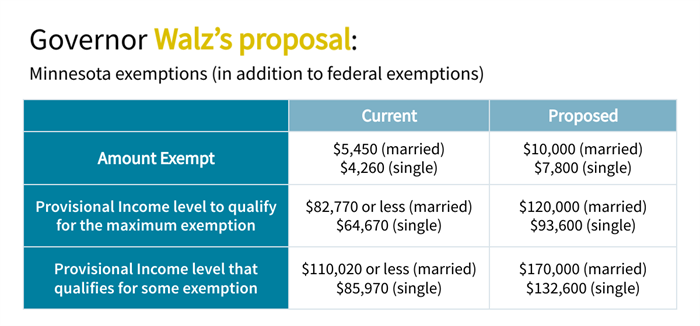

Governor Tim Walz proposes to build on Minnesota’s existing system of exemptions, which starts with federal exemptions. Federal tax law exempts 100 percent of Social Security for the lowest-income folks, 50 percent for another income group, and 15 percent for everyone. On top of that, Minnesotans can exempt an additional amount of their Social Security income from state income taxes until their incomes reach a certain level. Walz would increase the amount of Social Security income that can be subtracted and make it available to folks at higher income levels.

The proposed changes are in the table below, and note that state and federal exemptions are based on a complex measure of income called provisional income.

About 376,000 households would benefit from this proposal, receiving an average tax cut of $281. The total cost of these tax cuts from this proposal are estimated to be $220 million for FY 2024-25 and $250 million for FY 2026-27. Based on Department of Revenue data, we estimate that about 40 percent of the tax cuts would go to households with federal Adjusted Gross Incomes (FAGI) between $50,000 and $100,000, and 45 percent to those $100,000 to $150,000. Households with FAGI over $250,000 would receive no additional tax cut.

Representative Jessica Hanson’s House File 1040 takes a slightly different approach. Her proposal would no longer calculate Social Security exemptions based on a household’s provisional income, and instead use the more familiar Adjusted Gross Income (AGI), like many other elements of state tax law. Minnesotans could exempt 100 percent of their taxable Social Security income from state income taxes if their AGI is no more than $80,000 for married filing joint filers or $62,500 for single or head of household filers. Folks with AGI above those income thresholds may qualify for some exemption, and the income thresholds would be adjusted annually for inflation.

According the Minnesota Department of Revenue, about 269,000 households would benefit from House File 1040, receiving an average tax cut of $524. The total cost of these tax cuts under this proposal would be $298 million in FY 2024-25 and $349 million in FY 2026-27.

House Research estimates that 80 percent of the tax cuts from this proposal would go to households with AGI between $50,000 and $100,000, and no tax cuts would go to households with AGI above $150,000.

It’s a positive sign that the debate around Social Security exemptions now more frequently recognizes that federal and state tax laws already provide significant exemptions that prioritize low- and middle-income seniors, and that it is not necessary to spend hundreds of millions of dollars on tax cuts for the wealthiest if policymakers want to address financial struggles that some Minnesota seniors are facing.

It seems clear that some changes to Social Security exemptions will happen this year; Minnesota will be best served if those changes are narrowly targeted and protect resources for critical public investments in our seniors, their families, and communities.