Thousands of Minnesotans have little reason to celebrate this Labor Day. Even though the state’s economy is slowly improving, many workers are struggling to climb out of the Great Recession. They are still looking for jobs, working part time, earning less than they did before the recession, or accepting jobs that don’t meet their abilities.

Minnesota’s overall economy is improving, but a closer look tells a disturbing story: many Minnesotans still lack quality jobs that would allow them to support themselves and their families.

- Low-wage workers are seeing much slower wage growth than high-wage workers.

- More people are unemployed for longer periods of time, which can have a large impact on a person’s finances, career prospects and family.

- Many workers are underemployed, and still need jobs with more hours and that match their skills.

- Many are accepting part-time work because they cannot find full-time jobs.

- Fewer Minnesotans are working or looking for work, as the recovery has not yet created enough jobs.

The Great Recession and slow economic recovery have hit some Minnesotans especially hard. The gap between the wages of high-income Minnesotans and other Minnesotans is growing, and women and people of color are more likely to lack good jobs that allow them to pay their bills and support their families, demonstrating that many Minnesotans are not sharing in the state’s economic growth. The state of working Minnesota will only improve when more Minnesotans have opportunities for good jobs.

Wage Inequality Growing in Minnesota

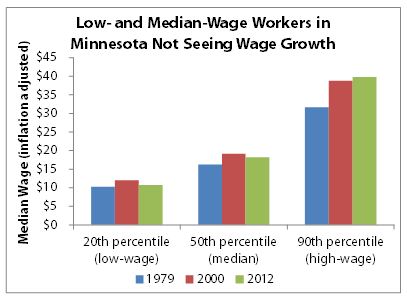

The benefits of economic growth are not creating broad-based prosperity. Wage inequality – the gap between the wages of low- and high-wage Minnesotans – has been growing for more than 30 years.[1]

Inequality has increased as wages for high-earning workers have grown faster than for low- and middle-income earners.[2] Between 1979 and 2012, high-wage workers saw their wages increase by 26 percent, but the wages of low-wage workers only increased by 5 percent and middle-income workers’ wages increased by 12 percent.

Inequality has increased as wages for high-earning workers have grown faster than for low- and middle-income earners.[2] Between 1979 and 2012, high-wage workers saw their wages increase by 26 percent, but the wages of low-wage workers only increased by 5 percent and middle-income workers’ wages increased by 12 percent.

In 1979, the median wage of high-wage workers in Minnesota was 3.1 times the median wage of low-wage workers. As of 2012, it had grown to 3.7 times higher.

During the recession, low-wage workers saw the largest drop in their wages, which fell nearly 3 percent from 2007 to 2012. During this same time period, middle-income workers’ wages stagnated and remained largely unchanged, while high-wage workers saw their wages increase by 2 percent.

Income inequality contradicts our country’s values that hard work should pay off and everyone should have the opportunity to succeed. The reality is that not all Minnesotans are sharing in the state’s economic growth.

Gender and Racial Wage Gaps Persist

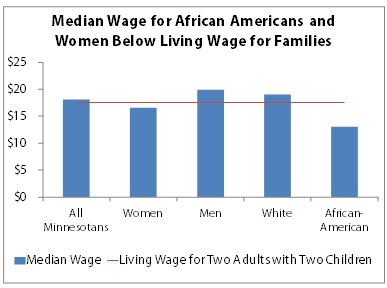

While the median wage in Minnesota is higher than the U.S. median wage, many women and African-Americans in Minnesota are still not making enough to support their families.[3]

African-American Minnesotans are not benefiting from the economic recovery as much as their white counterparts. They have a much lower median wage than white Minnesotans. As of 2012, the median wage for African-American Minnesotans was $13.07, which is only about 70 percent of the median wage for white Minnesotans.[4] While the median wage for all Minnesotans is higher than the U.S. median, in contrast, African-American Minnesotans earn less than their counterparts nationally. African-Americans are a growing population in Minnesota, and Minnesota needs to draw on the human capital of all its residents to build a strong economy.[5]

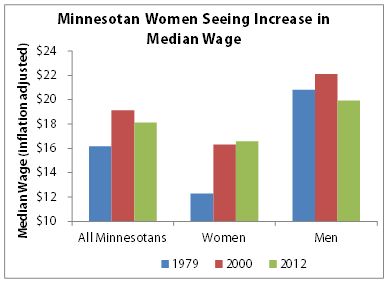

Women have been making gains, but their wages still lag behind men's. Women have long earned lower wages than men in Minnesota, but the gap is slowly narrowing. In 1979, the median wage for women was $12.29 (in 2012 dollars), or only about 60 percent of the median wage for men.

By 2012, the median wage for women in the state had increased to $16.57, over 80 percent of the median wage of males. The gap has narrowed because women’s wages have been rising while men’s wages have fallen recently. Nevertheless, a sizeable gap still remains between men’s and women’s wages.

By 2012, the median wage for women in the state had increased to $16.57, over 80 percent of the median wage of males. The gap has narrowed because women’s wages have been rising while men’s wages have fallen recently. Nevertheless, a sizeable gap still remains between men’s and women’s wages.

African-American and female Minnesotans often do not make enough to support a family. The JOBS NOW Coalition calculates what it costs to cover the basic needs of a family in Minnesota.[6] In 2009, a two-parent family of four with one parent working needed to earn $17.52 per hour to make ends meet.

More than half of African-Americans and women in Minnesota earn wages below this figure.

More than half of African-Americans and women in Minnesota earn wages below this figure.

Recession and Slow Recovery Leave Many Minnesotans Without Good Jobs

Minnesota’s workforce as a whole is recovering from the recession better than in other states, but that recovery has not reached everyone. Although unemployment has fallen during the economic recovery, job creation has not been enough to avoid relatively high shares of workers being underemployed or staying out of the workforce.

More Minnesotans are unemployed for long periods of time. The percentage of Minnesotans who have been unemployed for more than six months reached a three-decade high of 38 percent in 2011. That figure has come down a bit, but it still remains much higher than in the past. In the early 2000s, only 12 percent of Minnesotans were counted among the long-term unemployed.

Many working Minnesotans need more hours and jobs that match their expertise. Underemployment – when a worker needs full-time employment or is not making full use of his or her skill set – is also twice as high as it was in 2000. In 2012, nearly 12 percent of Minnesotans in or marginally attached to the labor force were underemployed. When Minnesotans are underemployed, it’s even harder for them to support their families.

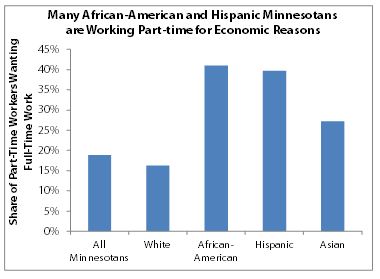

Many part-time workers want full-time work. The tough economy and slow recovery mean that more Minnesotans who wish to work full time are settling for part-time work. These workers are described as “working part time for economic reasons.” During the recession, 21 percent of all part-time workers in Minnesota would have preferred full-time work. While this figure has improved slightly to 19 percent, it still remains two and a half times the rate in 2000.

Fewer Minnesotans are working or looking for employment. The labor force participation rate – the percent of the state’s population age 16 and older in the workforce – declined sharply during the recession. Labor force participation typically declines in weaker economies, but should bounce back during a recovery as job prospects improve. That has not happened in Minnesota. In 2000, 75 percent of Minnesotans were participating in the labor force, but by 2012, participation dropped by nearly five percentage points, the lowest point since 1980. Many Minnesotans became frustrated by the lack of jobs and left the labor force during the recession, and they have not started looking again.

People of color are more likely to be underemployed. In general, white Minnesotans have done fairly well in the state’s economy. They have lower rates of unemployment, underemployment, and workers who have had to take part-time work because of the economy.

People of color, however, have a very different experience. Hispanic Minnesotans have a very high labor force participation rate, 76 percent, compared to the overall state rate of 70 percent. But they have a higher unemployment rate at 8.4 percent, and a very high share of part-time workers for economic reasons at 40 percent.

People of color, however, have a very different experience. Hispanic Minnesotans have a very high labor force participation rate, 76 percent, compared to the overall state rate of 70 percent. But they have a higher unemployment rate at 8.4 percent, and a very high share of part-time workers for economic reasons at 40 percent.

Asian- and African-American Minnesotans have struggled in the labor force during the recovery. Their labor force participation rates are below the state average, and both have high unemployment rates. The unemployment rate for African-American Minnesotans is almost 14 percent. A very high share of Asian- and African-American Minnesotans are working part time for economic reasons: 41 percent of African-American part-time workers would prefer full-time work, as would 27 percent of Asian-American part-time workers. These numbers show that there are huge gaps in access to economic opportunity in the state.

Policy Choices can Improve the State of Working Minnesota

Minnesotans are still feeling the effects of the Great Recession and the slow economic recovery. The lack of enough good jobs means that too many are unemployed, underemployed, or have left the labor force entirely. And too many workers earn wages that are too low to make ends meet.

State and federal policymakers should adopt policies that enable more Minnesotans to find quality jobs and support their families. These include:

- Policies that improve job quality, such as the minimum wage; and ensuring that economic development efforts include a focus on job quality and reaching communities with less economic opportunity.

- Policies that help low-wage workers make ends meet and move into the middle class, including affordable higher education and skills training, child care assistance and affordable health care.

Increasing the minimum wage is perhaps the most immediate step that state and federal policymakers can take to improve job quality. The minimum wage is an important source of income for many families, but its purchasing power has eroded over time. The federal minimum wage of $7.25 was last increased in 2009. Minnesota’s minimum wage is lower: some Minnesotans working for small businesses earn just $5.25 per hour. Almost two-thirds of Minnesota’s minimum-wage earners are 20 or older, and over one-quarter work full time. An increase in the minimum wage would significantly boost the purchasing power of many Minnesotans.

Another important policy to support Minnesota’s workers is improving access to affordable quality health care. Minnesota made important progress in the 2013 Legislative Session to expand health insurance for low-income Minnesotans; and created MNsure, a state health insurance marketplace where working Minnesotans can compare, shop for, and buy health insurance. Some Minnesotans will qualify for public insurance options, while others will receive federal tax credits and other assistance to help them afford health insurance that fits the needs of their families. Although Minnesota has taken great strides to improve access to health insurance, more still needs to be done to make insurance more affordable for middle-income Minnesotans.

Other policies that support low-wage workers include:

- Increasing access to affordable education and job training to allow individuals to build new skills and gain high-quality jobs. Decisions made in the 2013 Legislative Session to increase financial aid and freeze tuition at public colleges and universities took important steps to ensure that these opportunities are available to more Minnesotans, and reduce the burdens of student debt.

- Ensuring more children can access affordable early childhood education that prepares them to succeed in school and allows their parents to work. Minnesota made important investments in early childhood education in 2013, but many families still are unable to find affordable, quality child care, due to underfunding of child care assistance.

- Strong Unemployment Insurance systems at the state and federal levels help workers replace lost wages during times of unemployment, helping them to make ends meet during tough times and eventually return to the workplace.

Minnesota’s future depends on a strong and vibrant workforce. But many Minnesotans are still struggling to climb out of the recent recession, even though the economy is recovering. Too many Minnesotans, especially women and people of color, are not finding quality jobs that would allow them to support their families. Investments that increase opportunities for people to find those jobs are crucial to a bright future for our state.

By Caitlin Biegler and Nan Madden