By the start of 2014, it appeared that the economic recovery was taking hold. Minnesota had recovered the jobs lost during the recession, and unemployment was comfortably below the national figures. But these overall figures disguise the fact that many Minnesota workers are not sharing in the state’s economic growth. The same kinds of workers that suffered the highest levels of unemployment during the recession - the less educated, the young, single parents and people of color – still face higher unemployment rates during the recovery [1].

The state’s unemployment rate was 4.8 percent as of March 2014, well below the national level. However, that figure translates into almost 146,000 Minnesotans looking for work [2]. Extended periods of unemployment can force families to tap savings meant for education or retirement, and cut back on essentials like health care or food.

When too many Minnesotans are out of work, that depresses consumer spending – an important engine of economic growth. And when Minnesota workers aren’t prepared for or can’t get to the state’s job opportunities, that can also hamper economic growth. That has consequences for us all.

In the 2014 Legislative Session, Minnesota policymakers took several steps so that more Minnesotans can get good jobs to support themselves and their families. Policymakers raised the minimum wage to $9.50 by 2016, which will boost wages for around 325,000 Minnesota workers and could reduce turnover in low-wage positions. The Women’s Economic Security Act included provisions to help women get and keep good jobs. And more Minnesotans will be able to gain the education they need to find employment, because of improvements to the Minnesota Family Investment Program (MFIP) and increased funding for Adult Basic Education.

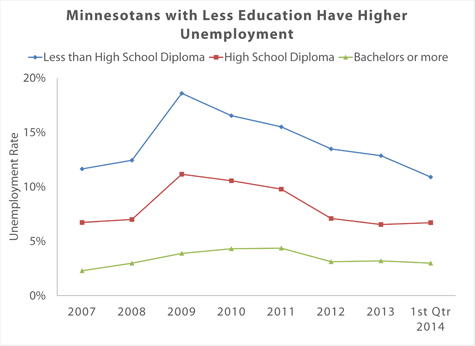

Minnesotans with Less Education Struggle in the Job Market

Minnesotans with more education have greater success in the job market than those with less. While the gap in unemployment rates between college graduates and those with less education is narrowing, Minnesotans with lower levels of education are still finding it far more difficult to find employment.

- Minnesotans without a high school diploma are more than 3.5 times as likely to be unemployed as those with a college degree. In the first quarter of 2014, 10.9 percent of Minnesotans without a high school education were unemployed.

- For those with a high school diploma, unemployment held at 6.7 percent in early 2014, about the same as it was in 2007. While this is lower than the unemployment rate for Minnesotans without a high school diploma, it is more than twice as high as the unemployment rate for those with a college degree.

- As of March 2014, the unemployment rate for college graduates was just 3.0 percent. This group weathered the recession far better than the others, and continues to experience low unemployment.

Younger Minnesotans Experience High Unemployment

Young Minnesotans are more likely than other age groups to be unemployed, which can be a significant setback at a critical time in their working careers that may harm their future earnings. While unemployment among young adults has declined substantially since the recession ended, they are still struggling in the job market.

- Young Minnesotans experienced unemployment rates as high as 13.5 percent during the recession. While this figure has decreased considerably, it is still 8.3 percent as of the first quarter of 2014.

- Other age groups saw a less dramatic increase in unemployment during the recession, and unemployment rates are falling back to what they were before the recession. For 25- to 44-year-olds, the unemployment rate fell to 3.9 percent in the first quarter of 2014; and for 45- to 64-year-olds, the rate was 4.4 percent.

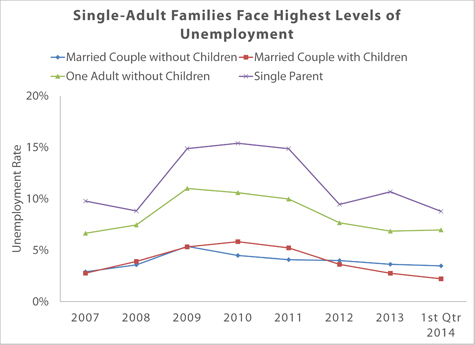

Single Parents Are Struggling in Minnesota’s Economic Recovery

Households headed by a single adult experience more difficulty in Minnesota’s job market than married couples, with single-parent families facing the greatest challenges.

Prolonged unemployment can be harmful to children, with the loss of wages making it difficult to provide nutritious meals and a safe environment, and parental stress causing greater tension in the home [3]. A household headed by a single adult is particularly vulnerable after losing a job, since there isn’t a second income earner to help weather a stretch of unemployment.

- Single parents experienced very high unemployment rates during the recession. While the unemployment rate had dropped by the first quarter of 2014, still 1 out of 11 single parents in the workforce were looking for work.

- Single adults without children also face high levels of unemployment, and unemployment rates among this group remain higher than before the recession hit. In the first quarter of 2013, 7.0 percent of single adults without children were seeking employment.

- Married couples – with and without children – have seen lower levels of unemployment for the past few years, never going above 6 percent even during the recession [4]. In the first quarter of 2014, unemployment among married couples without children was 3.5 percent and among couples with children the rate was 2.2 percent.

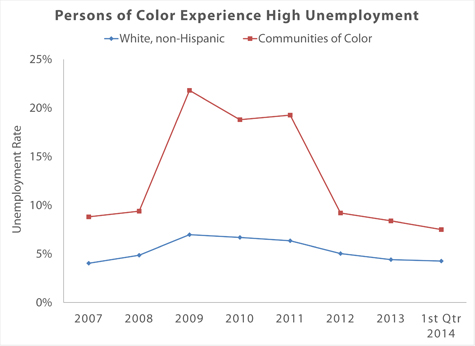

Minnesota’s Communities of Color Experience Higher Unemployment

Unemployment among people of color in Minnesota has improved since the recession, but still remains much higher than for white Minnesotans [5]. This likely reflects many of the other unemployment gaps discussed in this paper, since people of color are more likely to be young or have lower education levels, as well as discrimination in the labor market [6].

- Unemployment among persons of color is now below pre-recession levels. However, the unemployment rate for people of color is still 3.2 percentage points higher than for white Minnesotans.

- Many communities experience much higher unemployment. For example, the unemployment rate in 2012 was 19.2 percent for Native Americans in Minnesota and 17.7 percent for African Americans [7].

Progress on Addressing Disparities in Employment Was Made in 2014

Moving toward an economy that works for everyone means increasing the number of good jobs in the state and improving the ability of Minnesota workers to get those jobs. Minnesota policymakers took several important steps in the 2014 Legislative Session to remove barriers to employment for those Minnesotans who have a harder time finding jobs – the less educated, young people, single parents and people of color.

By raising the minimum wage to $9.50 by 2016, Minnesota policymakers boosted the wages of about 325,000 Minnesota workers. Research suggests that this will reduce turnover in these jobs, and it means that more Minnesotans in these jobs will be closer to making ends meet.

Women are more likely to be in low-wage professions, and the Women’s Economic Security Act passed this year includes several provisions to help women attain good jobs and meet their family obligations without losing their jobs. These include:

- Expanding workplace protections for workers who also are caring for children, elders or disabled family members.

- Supporting employers to recruit and prepare women to enter non-traditional and high-wage jobs.

- Equal pay protections.

Also thanks to legislation passed this year, the very low-income parents who participate in the Minnesota Family Investment Program will be able to access the education and training they need to succeed in the workforce. Policymakers also improved Adult Basic Education by requiring these programs to offer English language instruction to better prepare new Minnesotans for the workforce.

The economic recovery is narrowing the gaps in unemployment. Minnesota policymakers also did their part this session toward all Minnesotans having the opportunity to succeed

By Clark Biegler